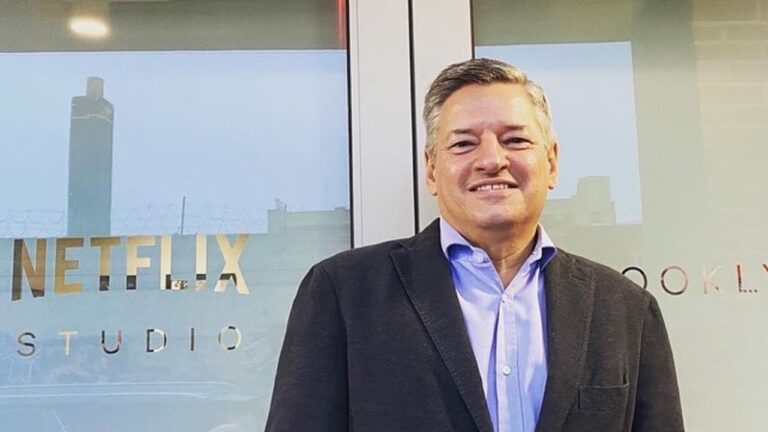

Ted Sarandos, co-CEO of Netflix, seemed to allay these fears about their proposed acquisition of Warner Bros. Discovery, which has been estimated to be 82.7 billion dollars. Ted Sarandos gave a lengthy interview to the New York Times on January 16, 2026, in reaction to what has been characterized as ‘emotional’ responses from the film industry about their proposed acquisition, and has reiterated a ‘hard number’ commitment to ‘save the movie theater experience.’ This particular interview is a very valuable example of PR and reflects that they are ‘a partner, not a threat.’

“When this deal closes, we will own a theatrical distribution engine that is phenomenal and produces billions of dollars of theatrical revenue that we don’t want to put at risk. We will run that business largely like it is today, with 45-day windows. I’m giving you a hard number. If we’re going to be in the theatrical business, and we are, we’re competitive people—we want to win. I want to win opening weekend. I want to win box office.“

This is causing quite an uproar in the film industry since it is the end of the 45-day ‘window,’ as it is commonly referred to. This is quite refreshing, since it is quite evident that they don’t intend to look for loopholes in the movie theater.

The 45-Day commitment and box office strategy

The theatrical window was ‘an ancient and sacred tradition in the entertainment industry,’ but there was a worry that Netflix might bring something such as Superman or Minecraft onto the platform prematurely. In this regard, there was no ambiguity in Sarandos’ stance on:

- The Commitment: Netflix agrees to honor the industry-standard 45-day window for Warner Bros. titles.

- “The Engine” Theory: When this deal is consummated, Netflix will own a theatrical distribution engine that is phenomenal and produces billions of dollars of theatrical revenue that they do not want to risk.

Sarandos went on to draw parallels between the strategy of Netflix and the hostile takeover bid of Paramount-Skydance. He said that even though Netflix has expansion strategies in terms of budget and production of movies in the coming years, the ‘synergy’ plan of $6 billion proposed by Paramount would result in layoffs, and this would cause chaos in the market. It’s not a cost-savings play; it’s a build. He further added that even the co-founder of Netflix, Reed Hastings, was on board with the acquisition once he realized the importance of the theatrical assets of Warner.

Comments, such as those made by Sarandos in relation to theater buildings described as “outdated,” fueled the backlash. The Nuance: “Outmoded for some” was an acknowledgment of an area that did not have access to theaters, not the experience itself. He started with an example from his own daughter in Manhattan, where theater is an important part of their culture, to show that Netflix understands the importance of movie-going.

The Roadmap of 2026

- Recommendation from WBD Board: Board urges stockholders to approve Netflix deal – WBD.

- Board Recommendation Equity Value: $27.75 per share (composed of $23.25 in cash and $4.50 in Netflix stock).

- Regulatory Timeline: About 12-18 months of DOJ/EU Commission approval.

- Linear TV Split: Discovery Global will spin off as a separate entity in the third quarter of 2026.

Taking into account such commitments, Sarandos is able to tout Netflix as not just the disruptor but also much more. The truth of the matter here is that with commitments to protect HBO, maintain the theatrical window, and boost revenue shares through box office revenue, Netflix is promoting the deal as some sort of salvation for the traditional and digital Hollywood.